Discover our Protection Package

Protection Package

Choose the Right Insurance for Your Journey

No matter how experienced or skilled a driver you are accidents on the road can, and do, happen. Being a responsible driver means taking all the necessary precautions to protect yourself, your family, and other road users.

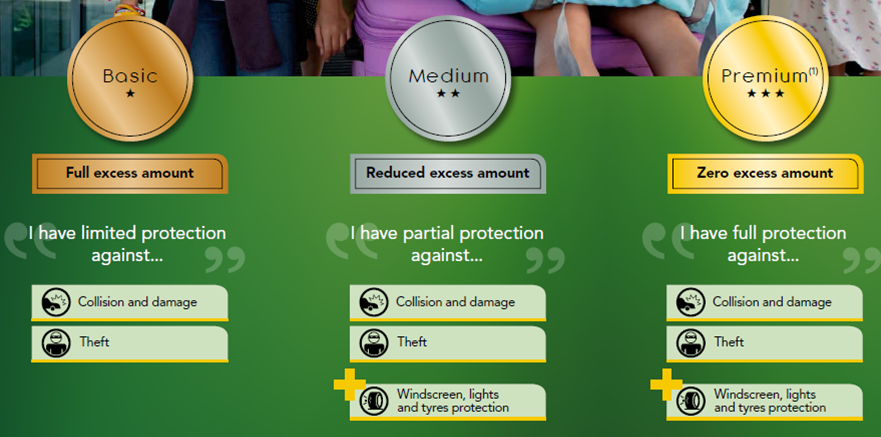

Europcar lets you choose the right protection package for your needs. Although our protection packages do vary depending on what country you’re in, what type of car you’re renting, and your age, you’ll usually be able to choose from three main protection plans: Basic Protection, Medium Protection, and Premium Car Rental Protection.

There's always a protection to fit your needs!

What are the new Europcar Philippines Protection packages?

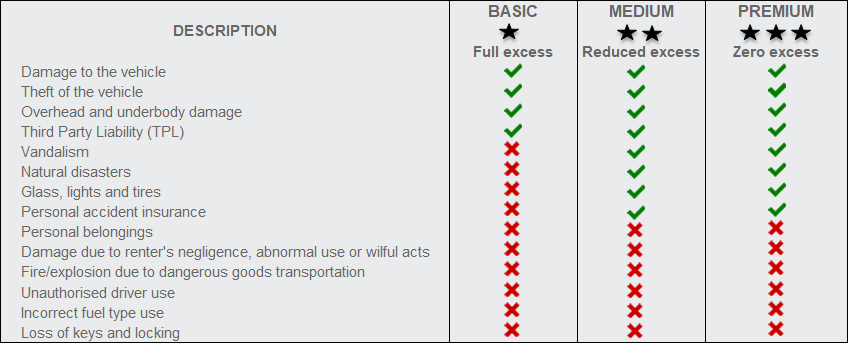

We offer three different packages: Basic Protection (included in the rentals except for US & CA customers), Medium Protection, and Premium Protection each with different levels of protection and reduction of excess amounts.

Basic protection is, in most cases, included in the quoted rental price.

It limits your financial liability in case of damage of the vehicle caused by collision, theft or attempted theft.

NOTE: Basic protection is mandatory for your rental. You must either be covered by your payment card (for USA and Canadian residents) or purchase Basic protection separately.

The excess amount for Basic Protection varies depending on the vehicle category chosen.

Basic Protections limits your financial liability up to the excess amount stipulated herein:

Damage Excess:

You are responsible to pay a damage excess as per category of vehicle in case of any damage regardless of fault.

Economy : Toyota Vios or Similar (EDMR, EDAR) - ₱10,000.00

Compact : Volkswagen Jetta or Similar (CDAR) - ₱15,000.00

Intermediate-Van : Toyota Innova or Similar (IVMR) - ₱20,000.00

Crossover SUV : Volkswagen Tiguan or Similar (SGAD) - ₱30,000.00

Luxury Van : Toyota Super Grandia or Similar (LVAD) - ₱30,000.00

Pick-Up Truck: Toyota Hi-Lux or Similar (IQND) - ₱30,000.00

Full sized Sedan : Nissan Altima or Similar (ICAR) - ₱30,000.00

Luxury SUV : Volkswagen Touareg or Similar (SGAD) - ₱30,000.00

Theft/ Total Wreck Excess:

You are responsible to pay a theft/total wreck excess as per category of vehicle in case of theft/total wreck regardless of fault.

Economy : Toyota Vios or Similar (EDMR, EDAR) - ₱40,000.00

Compact : Volkswagen Jetta or Similar (CDAR) - ₱50,000.00

Intermediate-Van : Toyota Innova or Similar (IVMR) - ₱60,000.00

Crossover SUV : Volkswagen Tiguan or Similar (SGAD) - ₱70,000.00

Luxury Van : Toyota Super Grandia or Similar (LVAD) - ₱80,000.00

Pick-Up Truck: Toyota Hi-Lux or Similar (IQND) - ₱80,000.00

Full sized Sedan : Nissan Altima or Similar (ICAR) - ₱80,000.00

Luxury SUV : Volkswagen Touareg or Similar (SGAD) - ₱80,000.00

Reduces your financial liability in case of damage to the vehicle as a result of collision, theft or attempted theft.

Medium protection package also protects you in the event of damage to the windscreen, headlights or tires.

It also includes personal accident protection that provides indemnity for drivers and people in the vehicle in case of bodily injury or death.

The excess amount for Medium Protection varies depending on the vehicle category chosen.

Medium Protections reduces your financial liability up to the excess amount stipulated herein:

Damage Excess / Theft / Total Wreck Excess:

You are responsible to pay a damage/ Theft/ Total Wreck excess as per category of vehicle in case of any damage regardless of fault.

Economy : Toyota Vios or Similar (EDMR, EDAR) - ₱5,000.00

Compact : Volkswagen Jetta or Similar (CDAR) - ₱10,000.00

Intermediate-Van : Toyota Innova or Similar (IVMR) - ₱15,000.00

Crossover SUV : Volkswagen Tiguan or Similar (SGAD) - ₱15,000.00

Luxury Van : Toyota Super Grandia or Similar (LVAD) - ₱15,000.00

Pick-Up Truck: Toyota Hi-Lux or Similar (IQND) - ₱15,000.00

Full-sized Sedan : Nissan Altima or Similar (ICAR) - ₱15,000.00

Luxury SUV : Volkswagen Touareg or Similar (SGAD) - ₱15,000.00

Premium protection package waives your financial liability (ZERO EXCESS) in case of damage to the vehicle, windscreen, mirrors, headlights and/or tires as a result of collision, theft or attempted theft.

It also includes personal accident protection covering drivers and passengers in the event of bodily injury or death.

You have the choice to either accept or decline these protections. These protections will not apply if you violated the terms of the Rental Agreement (R.A). If you decline these protections, you are totally responsible for returning the rental car to Europcar in the same condition it was rented and you are responsible for any damage to or loss of the rental car up to the full replacement value, regardless of fault, subject to all applicable laws. This includes, estimated cost of repairs, towing, and storage, impound fees, loss of use, claims processing fees, attorney’s fees, and administrative charges. In the event that you purchase your protection packages or any Vehicle Insurance from other parties, you are still fully liable to pay for any charges that may be assessed by the Europcar Rental Agent and you are solely responsible for processing its refund to the other parties where you purchase your Vehicle Insurance/ Protection.

By purchasing Medium or Premium Protection, you are covered by Personal Accident Insurance (PAI)

Medical and Death benefits for bodily injury resulting from vehicle accident. You are covered of accidental death benefits up to ₱200,000.00 per person based on your vehicle seating capacity and medical/hospital reimbursement up to ₱20,000.00 per person based on your vehicle seating capacity.

By purchasing Europcar Protection Packages, your rented vehicle is covered by the following Third Party Liability (TPL) insurance.

Third Party Death Claim Accident - Coverage up to ₱100,000.00

Excess Third Party Bodily Injury - Coverage up to ₱450,000.00 medical / hospital reimbursement per accident

Property Damage - Coverage up to ₱500,000.00 per accident.

In case of accident, you will shoulder all charges not covered by the insurance, or over and above those actually paid for by the insurance. For areas that are prone to terrorists and insurgents activities, you agree to safeguard the vehicle at all times and agree to shoulder all damages and downtime caused by these groups whether intentional or accidental. Terrorists / Insurgents Acts are not covered by the insurance.